Facebook Small Business Grant Program

COVID-19 Small Business Grant Program Valencia County

About Us

Facebook Small Business Grant Program

COVID-19 Small Business Grant Program Valencia County

About Us

About Us

Facebook Small Business Grant Program

COVID-19 Small Business Grant Program Valencia County

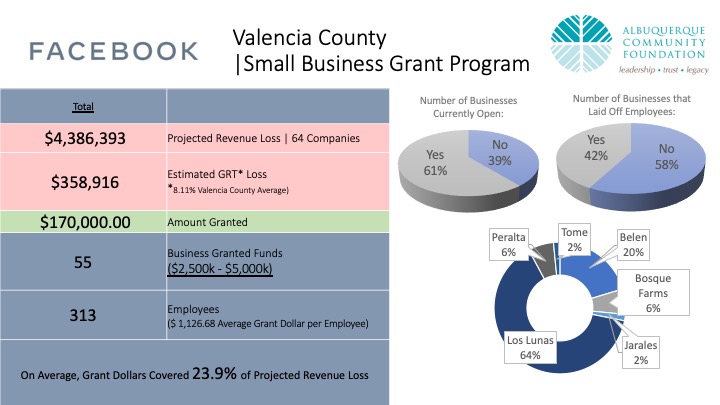

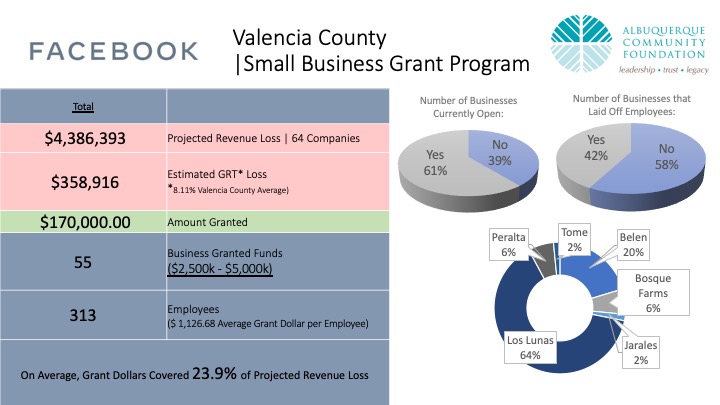

Results

Overview

What You Need to Know

Eligibility Criteria

- Business has a physical presence in Valencia County Business has 35 or less FTE (full-time equivalent employees)

- Business demonstrates an income loss due to COVID-19, incurred after March 1, 2020

- Business demonstrates a need for working capital to support its payroll expenses, rent, mortgage payments, utility expenses, or other similar expenses that occur in the ordinary course of its business

- National and regional chains where owners are not residents of Valencia County are not eligible

- Local franchise owners who reside in Valencia County are eligible

Grant Details

Grants are intended to provide funding to help eligible small businesses to replace lost revenue needed to pay for operational costs incurred between March 1, 2020 and December 31, 2020, to include:

- Payroll for employees

- Rent/mortgage

- Utilities

- Other operational or similar expenses that occur in the ordinary course of the recipient’s business

Amounts

Notification

Application

Businesses will be required to submit an online application on www.abqcf.org with the following questions:

- Provide the name and address of your business.

- State how COVID-19 has affected your business.

- Indicate how grant funds would be used (pay rent, employees, operational expenses).

- Indicate if your business is currently open.

- Total number of employees pre-COVID.

- Have you laid off any employees?

- Provide your business’ monthly mortgage/lease payment and utility expenses.

- Indicate forecasted monthly revenue loss for March - September 2020.

- What percentage of revenue have you lost due to COVID-19?

- Have your business’ hours of employment changed? If yes, please describe.

- Is your business owner-operated?

- Is your business a national chain?

- Do you have a physical location in Valencia County?

- Are your business owners residents of Valencia County?

- Have you contacted your lender for relief? If so, what is the status?

- List any additional aid received (Small Business Stabilization Fund, SBA Disaster Loan, franchise assistance, etc.) for which you have applied.

- List any deferred and/or abatements of rent, debt service, utilities, franchise fees or other expenses received or expected to receive due to COVID-19.

- Provide any additional information that you feel would be helpful for the review committee to know about your business during the COVID-19 crisis.

In addition to answering these questions, you will be required to provide the following documentation:

- 2019 year-end profit/lost statement (or P&L from opening to present for businesses open less than one year)

- Proof of business location (e.g., copy of current lease or deed, utility bill, etc.)

- Signed W-9

Distribution of Funds

IMPORTANT NOTE:

Any grant award may be considered taxable income and you will receive a 1099 for the funds at the end of this tax reporting year. Each business should consult with its tax professionals to determine whether the grant award is considered taxable income.

Grant recipient will be required to provide proof that the funds have been spent on the above approved uses as outlined in the applicant’s original application within 45 calendar days from disbursement of grant funds. Should you need to change how you will spend the grant, as indicated in your application, please contact grants@abqcf.org with a written request to change the use of the funds.

If the grant recipient fails to provide such proof and/or uses the grant funds for any other purpose, the grant recipient may be required to repay the grant funds upon demand by the Albuquerque Community Foundation.

Applicant/Grant Recipient Information

Albuquerque Community Foundation will not share an applicant’s or grant recipient’s proprietary and confidential data with any third parties except as needed during the grant review, disbursement and monitoring process and as required by applicable law.

Applicant and grant recipient data will not be sold. The information contained herein is subject to the actual grant agreement and the written terms and conditions contained therein, as the same may be amended from time to time. Albuquerque Community Foundation also reserves the right to make the final determination of any person’s or organization’s eligibility and/or qualifications for program benefits, and to make allocation of program benefits as it may, in sole discretion deemed appropriate.

Results

Overview

What You Need to Know

Eligibility Criteria

- Business has a physical presence in Valencia County Business has 35 or less FTE (full-time equivalent employees)

- Business demonstrates an income loss due to COVID-19, incurred after March 1, 2020

- Business demonstrates a need for working capital to support its payroll expenses, rent, mortgage payments, utility expenses, or other similar expenses that occur in the ordinary course of its business

- National and regional chains where owners are not residents of Valencia County are not eligible

- Local franchise owners who reside in Valencia County are eligible

Grant Details

Grants are intended to provide funding to help eligible small businesses to replace lost revenue needed to pay for operational costs incurred between March 1, 2020 and December 31, 2020, to include:

- Payroll for employees

- Rent/mortgage

- Utilities

- Other operational or similar expenses that occur in the ordinary course of the recipient’s business

Amounts

Notification

Application

Businesses will be required to submit an online application on www.abqcf.org with the following questions:

- Provide the name and address of your business.

- State how COVID-19 has affected your business.

- Indicate how grant funds would be used (pay rent, employees, operational expenses).

- Indicate if your business is currently open.

- Total number of employees pre-COVID.

- Have you laid off any employees?

- Provide your business’ monthly mortgage/lease payment and utility expenses.

- Indicate forecasted monthly revenue loss for March - September 2020.

- What percentage of revenue have you lost due to COVID-19?

- Have your business’ hours of employment changed? If yes, please describe.

- Is your business owner-operated?

- Is your business a national chain?

- Do you have a physical location in Valencia County?

- Are your business owners residents of Valencia County?

- Have you contacted your lender for relief? If so, what is the status?

- List any additional aid received (Small Business Stabilization Fund, SBA Disaster Loan, franchise assistance, etc.) for which you have applied.

- List any deferred and/or abatements of rent, debt service, utilities, franchise fees or other expenses received or expected to receive due to COVID-19.

- Provide any additional information that you feel would be helpful for the review committee to know about your business during the COVID-19 crisis.

In addition to answering these questions, you will be required to provide the following documentation:

- 2019 year-end profit/lost statement (or P&L from opening to present for businesses open less than one year)

- Proof of business location (e.g., copy of current lease or deed, utility bill, etc.)

- Signed W-9

Distribution of Funds

IMPORTANT NOTE:

Any grant award may be considered taxable income and you will receive a 1099 for the funds at the end of this tax reporting year. Each business should consult with its tax professionals to determine whether the grant award is considered taxable income.

Grant recipient will be required to provide proof that the funds have been spent on the above approved uses as outlined in the applicant’s original application within 45 calendar days from disbursement of grant funds. Should you need to change how you will spend the grant, as indicated in your application, please contact grants@abqcf.org with a written request to change the use of the funds.

If the grant recipient fails to provide such proof and/or uses the grant funds for any other purpose, the grant recipient may be required to repay the grant funds upon demand by the Albuquerque Community Foundation.

Applicant/Grant Recipient Information

Albuquerque Community Foundation will not share an applicant’s or grant recipient’s proprietary and confidential data with any third parties except as needed during the grant review, disbursement and monitoring process and as required by applicable law.

Applicant and grant recipient data will not be sold. The information contained herein is subject to the actual grant agreement and the written terms and conditions contained therein, as the same may be amended from time to time. Albuquerque Community Foundation also reserves the right to make the final determination of any person’s or organization’s eligibility and/or qualifications for program benefits, and to make allocation of program benefits as it may, in sole discretion deemed appropriate.